49+ where do i enter mortgage interest on tax return

Web Entering mortgage interest on tax return self assessment. File your taxes stress-free online with TaxAct.

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

File 2021 Tax Return.

. Web If you have a mortgage on your rental property enter on line 12 the amount of interest you paid for 2022 to banks or other financial institutions. Web You enter mortgage interest received just AS IF you had received a form 1099-INT from a bank. Ad Over 90 million taxes filed with TaxAct.

Web Mortgage Interest and Expenses. To do this sign into TurboTax and click Deductions Credits Search for PMI search button on top right of screen and click the Jump to. Web In order for your mortgage payments to be eligible for the interest deduction the loan must be secured by your home and the proceeds of the loan must have been.

Line 10 Enter on line 10 mortgage interest and points reported to you on. Web Open your return. Web Mortgage Interest Deduction available on our New York itemized deductions webpage.

Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an individual including a. Start basic federal filing for free. Find the 2022 federal tax forms you need.

Mortgages can be considered money loans that are specific to property. - Opens the menu. Where do I enter my rental homes mortgage interest.

Ad For Simple Returns Only. See If You Qualify To File 100 Free w Expert Help. We support income tax rebate refund deduction questions and more.

If they are incurred for the purpose of earning income by renting. Guaranteed maximum tax refund. If you have Mortgage Interest for your rental home you would enter the Mortgage.

Web Enter your mortgage interest costs on lines 8 through 8c of Schedule A then transfer the total from Schedule A to line 12 of the 2021 Form 1040. Web TurboTax Canada. In TurboTax you can enter your form 1099-INT by following.

Hi I have heard that the tax relief on mortgage interest has altered this year whereby you could. Get Live Help From Tax Experts Plus A Final Review Before You File - All Free. Web If you have Mortgage Interest for your rental home you would enter the Mortgage Interest as an expense on your Schedule E.

Filing your taxes just became easier. Do not deduct prepaid interest. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million.

The entry would be made by following these steps. Web Ask tax questions and get quick answers online. Ad Free tax filing for simple and complex returns.

Local Mortgage Choice Brokers In Merimbula Bega Mortgage Choice

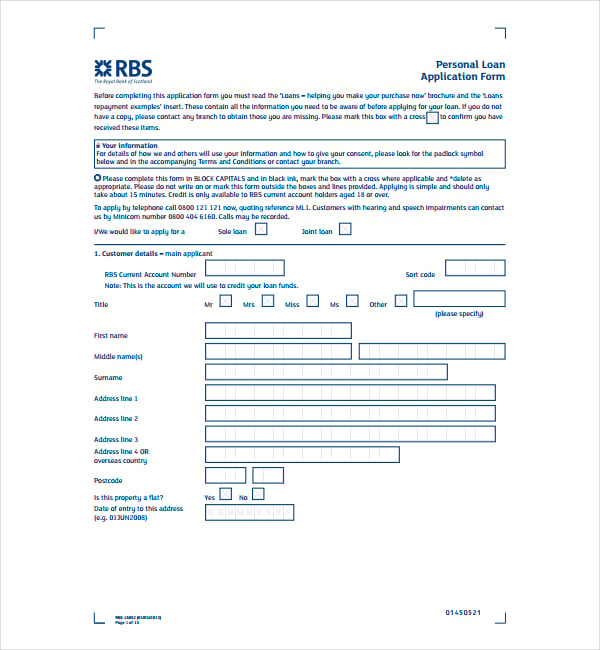

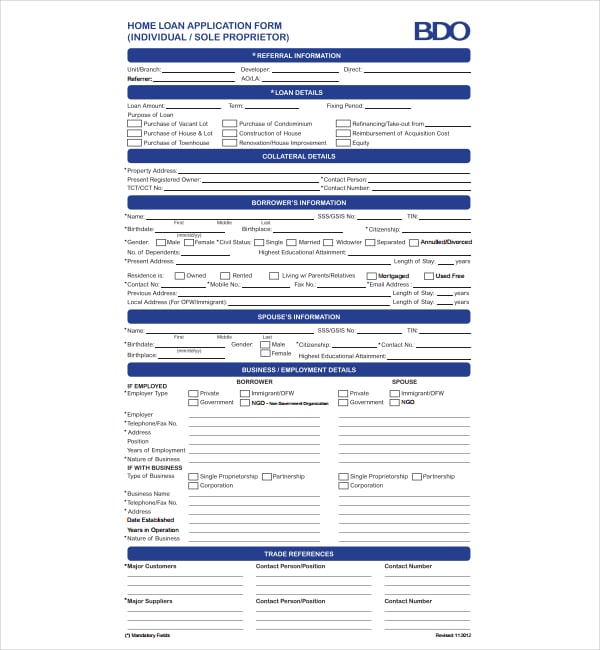

8 Loan Application Form Templates Word Pages Google Docs Pdf

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Nord Lb Group Annual Report 2007 Pdf 1 8

Sf 3

Pdf Families Incomes And Jobs

G210481mm01i003 Gif

Mortgage Interest Tax Deduction 2022 What If You Forget

Analysis 49 Examples Format Pdf Examples

Sf 3

8 Loan Application Form Templates Word Pages Google Docs Pdf

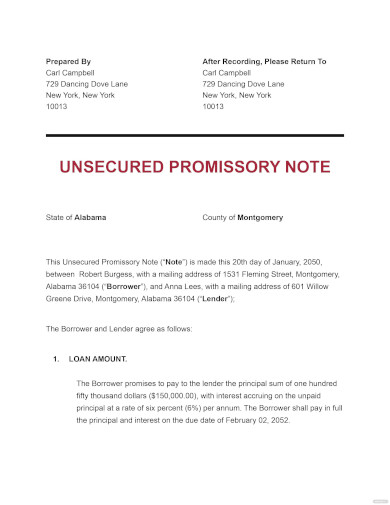

71 Sample Promissory Notes In Pdf Ms Word Google Docs Apple Pages

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1893 Session I Department Of Lands And Survey Annual Report On

Pdf Financial Aspects Of Determining Optimal Occupancy Factor For Hotels Based On Probabilistic Analysis Brian Sloboda And Viswanath Putcha Academia Edu

Exhibit991

The Second Best Time To Begin Investing Is Now Ubund

Contents F A S T Graphs Advisor Perspectives